capital gains tax usa

The amount taxed for capital gains depends on the income of the taxpayer and their filing status. Short-term capital gain tax rates.

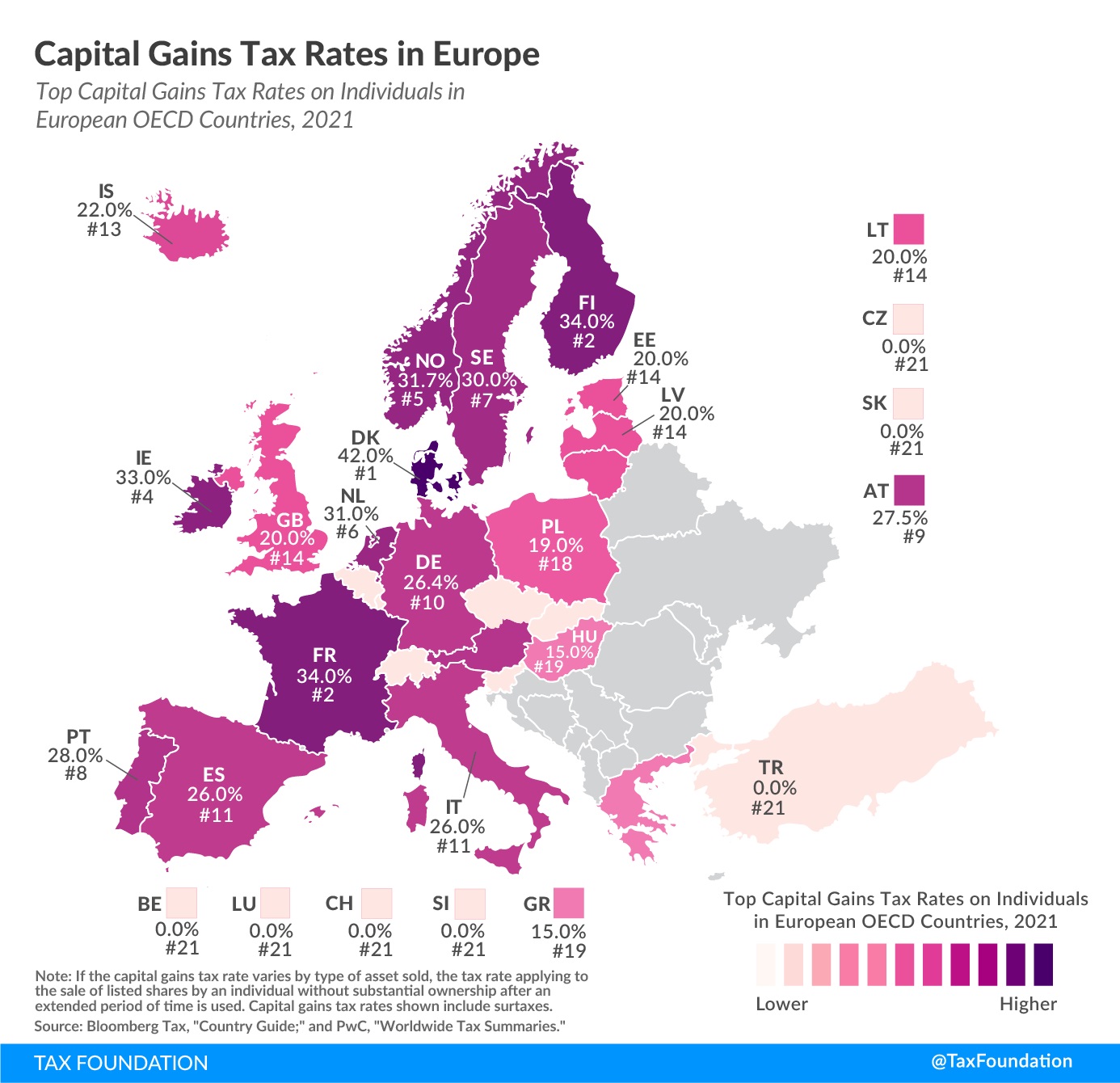

An Overview Of Capital Gains Taxes Tax Foundation

The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

. Short-Term Capital Gains vs Long Term. As part of this there is a long-term capital gains tax which is a 20 tax on investments held for more than. The tax rate on most net capital gain is no higher than 15 for most individuals.

Capital gains tax USA property occurs when an asset is sold for more than what was paid to acquire it. Unlike the long-term capital gains tax rate there is no 0. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

The highest-earning people in the United States pay a 238 tax on capital gains. 500000 of capital gains on real estate if youre married and filing jointly. 2021-2022 Capital Gains Tax Rates Calculator 1 week ago Feb 24 2018 2021 capital gains tax calculator.

The calculator on this page is designed to help you estimate your. The IRS typically allows you to exclude up to. Some states also levy taxes on capital gains.

250000 of capital gains on real estate if youre single. Capital gains occur when you sell a capital asset for more than you paid for it. Capital Gain Tax Law in the.

2022 capital gains tax rates. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. They are subject to ordinary income tax rates meaning theyre.

Some or all net capital gain may be taxed at 0 if your taxable income is. Capital Gain Tax Rates. Most states tax capital gains according to the same tax rates they use for regular income.

Weve got all the 2021 and 2022 capital gains. This usually happens from the sale of an. Most long-term capital gains are taxed at rates of 15 or less.

Source capital gains in the hands of nonresident alien individuals physically present in the United States for 183 days or more during the taxable year. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Short-term capital gains are gains apply to assets or property you held for one year or less.

Short-term capital assets are those held for less than 36 months. So if youre lucky. In 2021 and 2022 the capital gains tax rate is 0 15.

State Taxes on Capital Gains. A flat tax of 30 percent is imposed on US. You must report all 1099-B transactions on Schedule D Form 1040 Capital Gains and Losses and you may need to use Form 8949 Sales and Other Dispositions of Capital.

Capital Gains Tax Brack Evensky Katz Wealth Management

Biden Wants America To Have The World S Highest Tax Burden On Capital Gains International Liberty

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

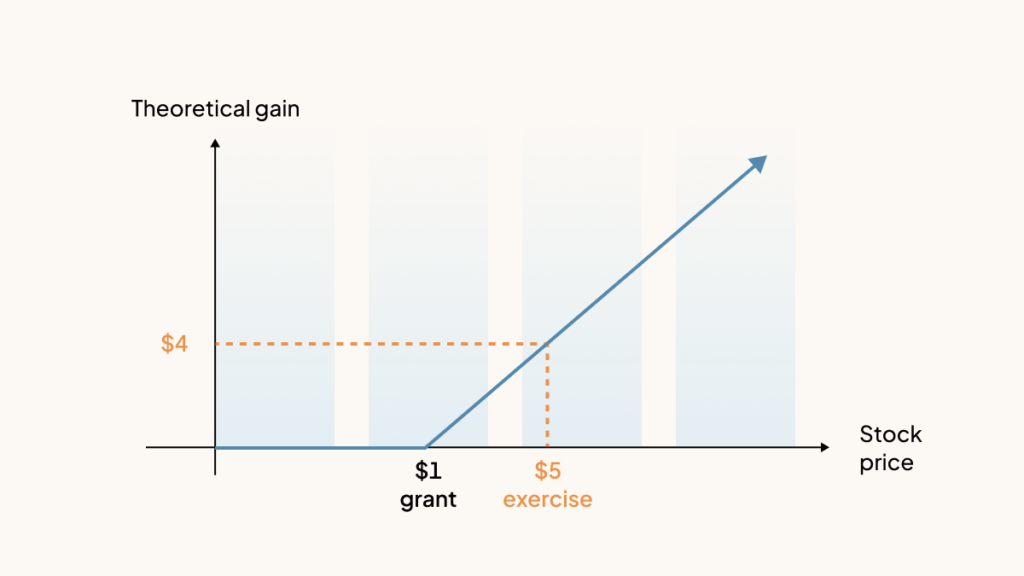

How Are Stock Options Taxed Carta

State Capital Gains Taxes Where Should You Sell Biglaw Investor

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Health Care Surtax Applies To Capital Gains Wsj

Biden Seeks Tax Hikes On Wealthy To Pay For Ambitious Families Plan

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

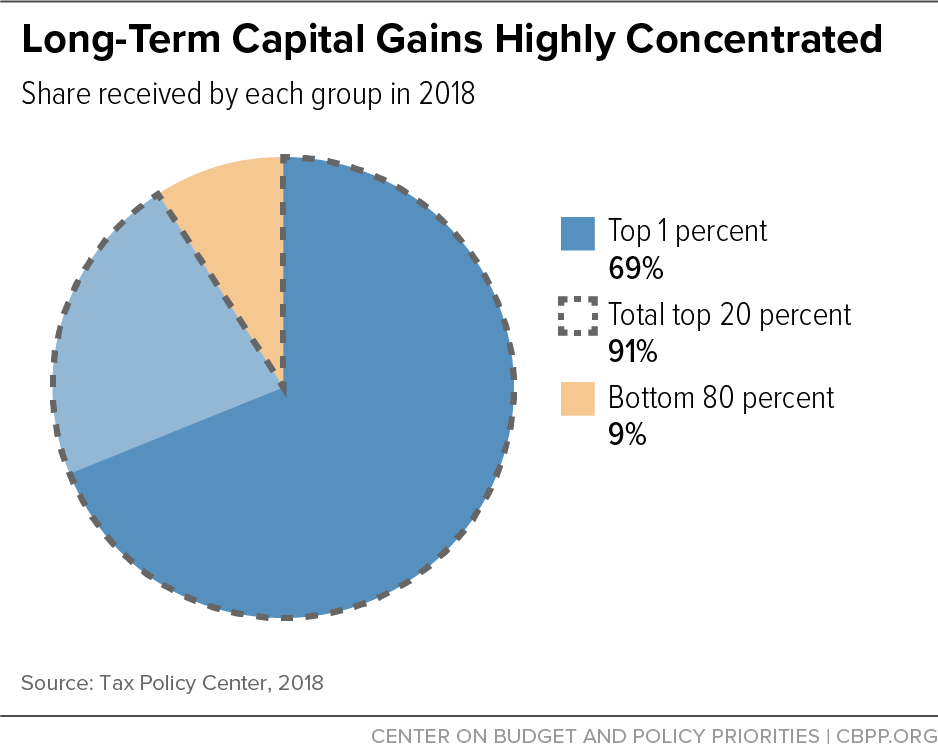

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

The Tax Impact Of The Long Term Capital Gains Bump Zone

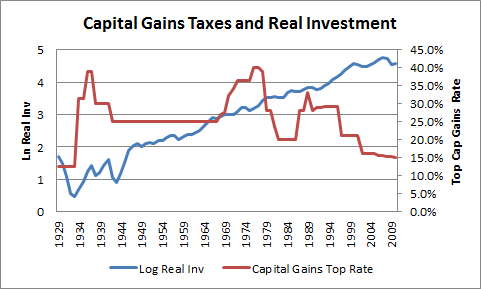

The Great Capital Gains Charade Mother Jones

Biden Capital Gains Tax Plan For Rich Expected To Pass But With Some Changes

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)